Problem 9.15 – Dantzler Corporation

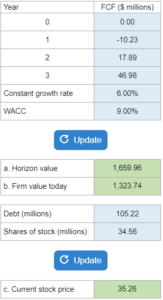

Given the cash flows for the following years, the expected FCF growth rate, and WACC... find the horizon/continuing value and the firm's market value today - then given debt and shares outstanding... estimate the current price per share

Experts Have Solved This Problem

Please login or register to access this content.