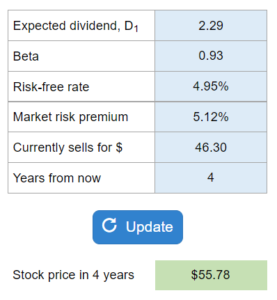

Problem 9.13 – Justus Corporation’s Stock

Given the year-end dividend, a beta, risk-free rate, market risk premium, and what the stock currently sells for... determine the constant growth rate assuming the market is in equilibrium.

Experts Have Solved This Problem

Please login or register to access this content.