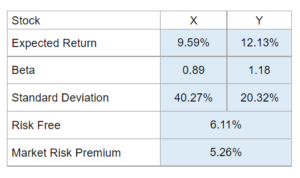

Problem 8.19 – Stock X & Stock Y

Given expected returns, beta coefficients, and standard deviations for both stocks... determine the coefficient of variation for both and interpret the results, and determine which stock will be impacted more when the market risk premium increases.

Experts Have Solved This Problem

Please login or register to access this content.