Problem 8.17 – Mutual Fund Manager

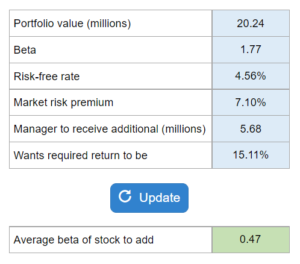

Given the portfolio value, beta, risk-free rate, market risk premium, manager's expected amount to receive, and what the manager wants the required return to be... find the average beta of the new stocks added to the portfolio.

Experts Have Solved This Problem

Please login or register to access this content.