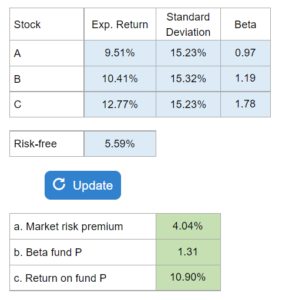

Problem 8.13 – Stocks A, B, & C / Fund P

Given a table of expected returns, standard deviations, and betas for stocks A, B, and C... determine the market risk premium, the beta for Fund P, and the required return on Fund P. Given that the three stocks are not perfectly correlated... comment on the portfolio's standard deviation given that the three stocks are not perfectly correlated.

Experts Have Solved This Problem

Please login or register to access this content.