Problem 8.05 – Beta & Required Return

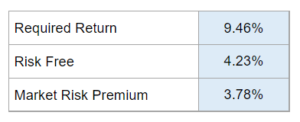

Given a required return for a stock, a risk-free rate, and the market risk premium... estimate the stock's beta and how the required return would behave if there is an increase in the market risk premium.

Experts Have Solved This Problem

Please login or register to access this content.