Problem 7.18 – Kempton Enterprises

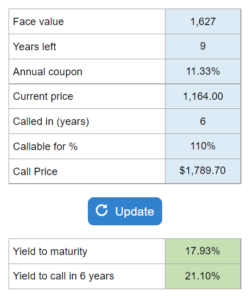

Given the face value, years left until maturity, annual coupon payment, current price, and what the bonds may be called for in the future... determine the yield to maturity, yield to call, and the yield investors expect to earn on Kempton bonds.

Experts Have Solved This Problem

Please login or register to access this content.