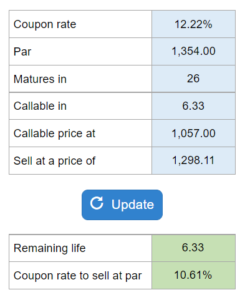

Problem 7.14 – Lourdes Corporation

Given the coupon rate, payment periods, par value, years to maturity, years and price till it's callable, and sell price... determine the best estimate of these bonds’ remaining life and determine the coupon rate Lourdes would need to set in order to issue new bonds at par.

Experts Have Solved This Problem

Please login or register to access this content.