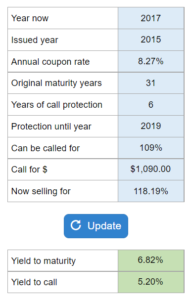

Problem 7.12 – Yield to Maturity & Yield to Call

You are considering the purchase of an outstanding bond that was issued on January 1. There are lots of dates, years, and numbers were provided.

Experts Have Solved This Problem

Please login or register to access this content.