Problem 7.10 – Pelzer Printing

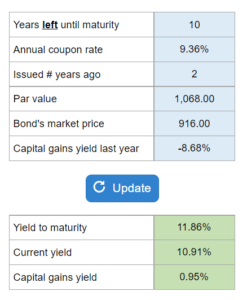

Given the years left to maturity for bonds outstanding, annual coupon rate, issue length, par value, market price, and capital gains yield for the previous year... find the yield to maturity on outstanding bonds, determine the current and capital gains yields, and also the actual realized yields if interest rates change.

Experts Have Solved This Problem

Please login or register to access this content.