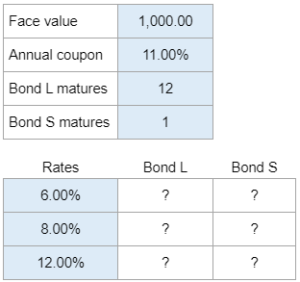

Problem 7.05 – Bond L and Bond S

Given the face value, annual coupon, Bond L maturity, Bond S maturity, and three rates... find the value of each bond and why the longer-term bond’s price varies more.

Experts Have Solved This Problem

Please login or register to access this content.