Problem 6-19, Ms. T. Potts New Kiln

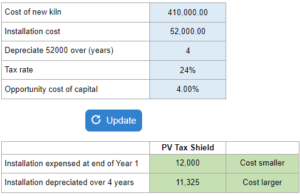

Given the cost of a new kiln, the installation cost, the years of use, the tax rate, and the opportunity cost... determine the present value of the tax shield using two different methods: a tax-deductible expense, or if it is depreciated straight-line. Which one results in the higher cost? The lower cost?

Experts Have Solved This Problem

Please login or register to access this content.