Problem 6.18 – Yield Curves

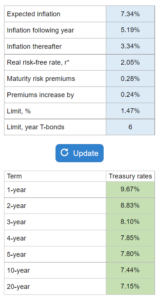

Given the inflation rates, real risk-free rate, maturity risk premiums, premium increase, and the limit:

a.) Calculate the interest rate on 1-year, 2-year, 3-year, 4-year, 5-year, 10-year, and 20-year Treasury securities

b.) Estimate and plot what you believe a AAA-rated company’s yield curve.

c.) On the same graph, plot the approximate yield curve of a much riskier lower-rated company.

Experts Have Solved This Problem

Please login or register to access this content.