Problem 6.14 – Expectations Theory & Inflation

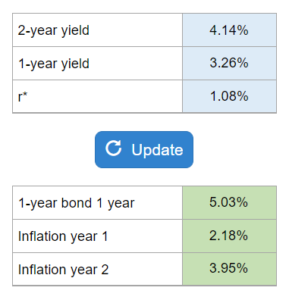

Given the 2-year and 1-year yield, along with r*:

a. Using the expectations theory, what is the yield on a 1-year bond 1 year from now?

b. What is the expected inflation rate in Year 1? Year 2?

Experts Have Solved This Problem

Please login or register to access this content.