Problem 26.08 – Cash v.s Stock as Payment

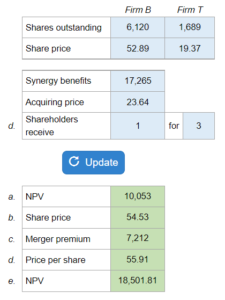

Given the premerger information on the bidding firm, synergy benefits, and acquiring price... figure out the NPV, share price, merger premium, price per share, and NPV under new conditions.

Experts Have Solved This Problem

Please login or register to access this content.