Problem 26.05 – Cash versus Stock Payment

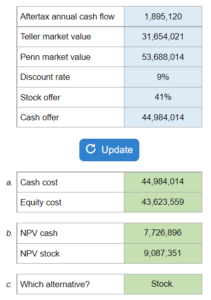

Given the aftertax cash flow, the market value for both companies, discount rate, stock offer, and cash offer... figure out the cost and NPV of each alternative and which alternative should the company choose.

Experts Have Solved This Problem

Please login or register to access this content.