Problem 25.08 – Delta

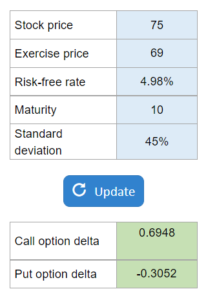

Given the stock price, exercise price, risk-free rate, maturity, and standard deviation... figure out the call option delta and the put option delta.

Experts Have Solved This Problem

Please login or register to access this content.