Problem 2.19 – Calculating Cash Flows

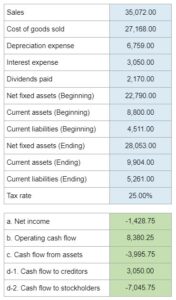

What is the net income, operating cash flow, cash flow from assets, and cash flow to creditors and stockholders for Martinez Industries given its operating results, assets and liabilities, and tax rate, assuming no new debt was issued?

Experts Have Solved This Problem

Please login or register to access this content.