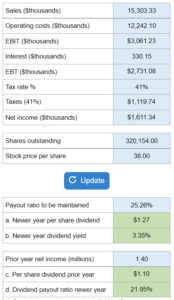

Problem 14.07 – Brooks Sporting Inc.

Determine the per share dividend, dividend yield in both the newer year and older year and then determine whether the company should maintain a constant dividend or constant dividend payout ratio.

Experts Have Solved This Problem

Please login or register to access this content.