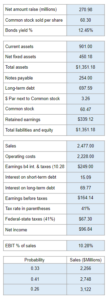

Problem 13.13 – Severn Company

Calculate earnings per share (EPS) under the debt financing and the stock financing alternatives at each possible sales level shown in the probability table. Then calculate expected EPS and EPS under both debt and stock financing alternatives. Then calculate the debt-to-capital ratio and the times-interest-earned (TIE) ratio at the expected sales level under each alternative.

Experts Have Solved This Problem

Please login or register to access this content.