Problem 12.09 – New Milling Machine

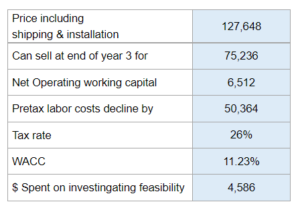

Evaluate the new milling machine project given its purchase cost, increase in net operating working capital, pretax labor cost savings, and the fact that the firm spent money on investigating the feasibility of using the machine.

NOTE: This problem is only for the 11e of the textbook. If you have an earlier edition, this won't work for you.

Experts Have Solved This Problem

Please login or register to access this content.