Problem 12.06 – Charlene

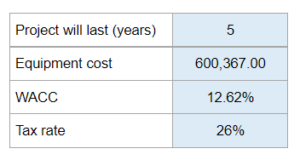

Determine the depreciation expense for straight-line and the bonus depreciation methods and determine the additional NPV gained from the preferred approach.

Experts Have Solved This Problem

Please login or register to access this content.