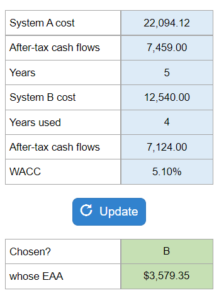

Problem 12.05 – Faleye Consulting (Equivalent Annual Annuity)

Given the cost, years, and after-tax cash flows for each system, and WACC... determine which system should be chosen assuming that both projects cant be repeated indefinitely based on the equivalent annual annuity (EAA) method.

Experts Have Solved This Problem

Please login or register to access this content.