Problem 11.19 – A Mining Company

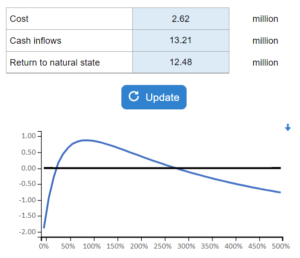

Given the initial outlay, cash inflows, and cash outflows... plot the project's NPV profile, if the project should be accepted, and the MIRR.

Experts Have Solved This Problem

Please login or register to access this content.