Problem 11.08 – A Mining Company

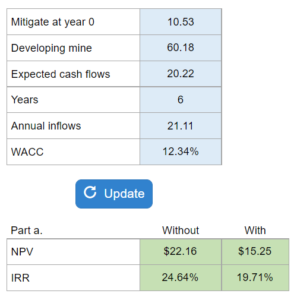

Given the additional amount firm could spend, initial outlay cost, and expected cash inflows... determine the NPV and IRR with and without mitigation, and decide how the environmental effects should be dealt with.

Experts Have Solved This Problem

Please login or register to access this content.