Problem 11.07 – Project M & Project N

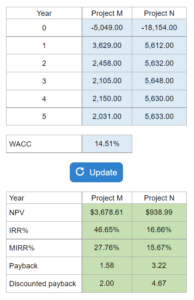

Given two cash flow timelines for project M and project N... calculate the NPV, IRR, MIRR and discounted payback for each project and make a recommendation.

Experts Have Solved This Problem

Please login or register to access this content.