Problem 10.15 – Kahn Inc.

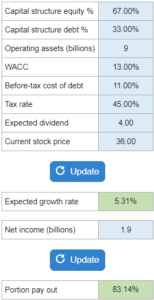

Given the target capital structure, operating assets amount, WACC, before-tax cost of debt, tax rate, expected dividend, and current stock price... find the expected growth rate, and what proportion the firm is expected to pay out as dividends.

Experts Have Solved This Problem

Please login or register to access this content.