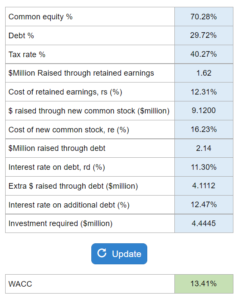

Problem 10.10 – Olsen Outfitters Inc.

Given common equity, debt, tax rate, cost of retained earnings, cost of new common stock, the interest rate on debt, extra raised through debt, and investment required... calculate the WACC.

Experts Have Solved This Problem

Please login or register to access this content.