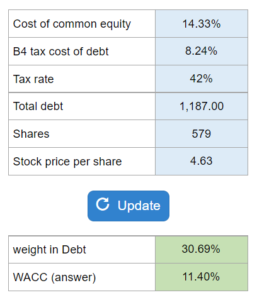

Problem 10.09 – Paulson Company

Given the cost of common equity, the tax cost of debt, tax rate, debt, amount of shares, and price per share… calculate the WACC using market-value weights.

Experts Have Solved This Problem

Please login or register to access this content.