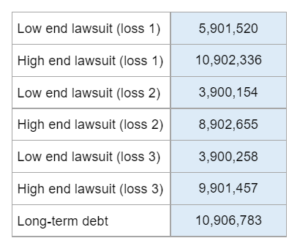

They give you a list of liabilities and ask you to show how they would be treated differently under both U.S. GAAP and IFRS. Then they ask which would show the lowest total liabilities.

Experts Have Solved This Problem

Please login or register to access this content.