E 20.15 – Bronson Industries

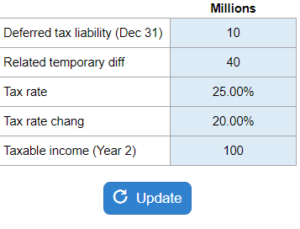

Given the deferred tax liability, the related temporary difference, the tax rate, the rate it changed to, and the taxable income... determine the type of change, prepare a journal entry, and whether they should revise prior financial statements or provide disclosure notes.

Experts Have Solved This Problem

Please login or register to access this content.