Blueprint Problem – EVA-MVA

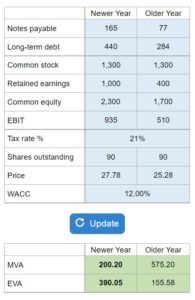

Select the appropriate terms from dropdown menus given multiple paragraphs pertaining to market value added and economic value added. Finally, compute EVA and MVA for Rosnan Industries for the quantitative problem.

Experts Have Solved This Problem

Please login or register to access this content.